WFCN – Considering that most pension systems have virtually disappeared in the modern era, joining a 401(k) is arguably the most effective retirement investment you can make.

One benefit of having a 401(k) is that you can save a ton of money on taxes because your gross income is decreased when you make contributions to your 401(k) because they are deducted from your paycheck before taxes are due.

Even while 401(k)s can have relatively low maintenance requirements, you should choose your investments carefully because if you don’t, the money will be placed in a money market account. However, how can you select these kinds of investments?

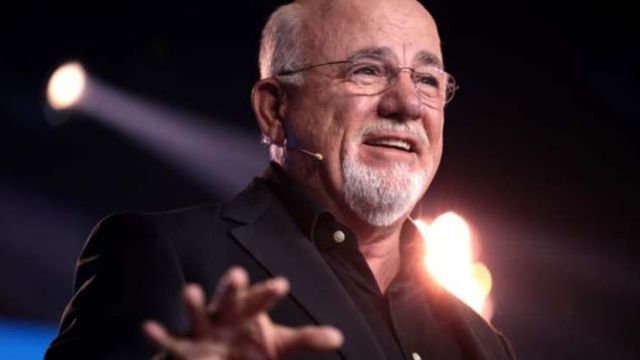

Financial expert Dave Ramsey offered some astute recommendations in a recent blog post on his site, Ramsey Solutions.

Here are 7 more 401(k) errors to steer clear of.

Discover Your Investment Choices

Finding out about your possibilities should be your first step when choosing assets for your 401(k). These are contained in the booklet or brochure that is sent with your business plan.

“As part of your company’s plan, your brochure or booklet will probably include at least three or four investment choices, but you could see a dozen or more — plus several alternatives to those pre-packaged options,” Ramsey said. “They might offer you mutual funds, company stock, or variable annuities.”

Ramsey then covered the fundamentals of popular investing alternatives that you would find on your employer’s plan.

The funds for the target date

There’s a good chance that the brochure or booklet for your workplace plan will strongly advocate for target date funds, according to Ramsey.

Target date funds are mutual funds with pre-arranged investment combinations based on the date of your intended retirement. Your initial mutual fund mix will be a good combination of growth stocks, but as retirement draws nearer, the composition will shift further toward conservatism.

Ramsey dislikes these, pointing out that your 401(k) will be primarily invested in bonds and money markets by the time you’re ready to retire. What is the issue with that?

Ramsey claimed, “[It] won’t give you the growth you need to support you through 30-plus years of retirement.”

Employee Stock Purchase Plans (ESPPs) and Company Stock

You may be able to purchase stock in your company if you work for a publicly traded company, which is any corporation in which stock is available for purchase.

SEE MORE –

State-by-State: Best Places to Live on a $100,000 Income

“When you first start working at your company or after a certain amount of time has passed, you might even be offered an ESPP (employee stock purchase plan),” according to Ramsey. “With a payroll deduction, an ESPP enables employees to purchase company stock at a discounted price.”

Ramsey quickly points out that even if a discount seems fantastic, you should hold off on acting before doing anything.

Ramsey stated, “Remember that company stock and ESPPs are single stocks, and we never advise investing in single stocks for retirement.” “It is dangerous to put all your eggs in one basket when it comes to the stock market, even if that basket is your brand-new job.”

In Ramsey’s opinion, these are the best choices:

Mutual Funds

Though it is impossible to cover mutual funds in a single paragraph, Ramsey does a decent job of encapsulating their function in 401(k) plans.

“With good reason, they’re the most popular kind of investment option available through 401(k) plans,” stated Ramsey. “Investors can pool their money to invest in dozens, often hundreds, of companies at once through mutual funds—professionally managed investments.”

Additionally, Ramsey clarified that because “you’re spreading your investments across many different companies with built-in diversification,” mutual funds are less risky than individual equities.

Retirement Plans

Annuities are a feature of many 401(k) plans, but not all of them. What do they consist of? Now let’s ask Ramsey that question.

The fundamental concept behind an annuity, according to him, is that you pay an insurance company, and in exchange, they guarantee to grow your money and pay you back when you retire, providing you with a reliable source of income all through your retirement.

According to Ramsey, “fixed annuities are exactly what they sound like: a savings account that has been enhanced and has a fixed interest rate, which is currently 5% or less.” “That low rate of return won’t stand a chance against the rate of inflation, even though it sounds simple and predictable.”

Another sort of annuity that makes things a little more confusing are variable annuities.

“Essentially, they’re mutual funds enclosed within an annuity,” stated Ramsey. “And that’s why those retirement payments are called variable—their performance will be based on how well those mutual funds perform over time.”

Even while Ramsey favors them over fixed annuities, he still does not advocate for them.

“Too many costs! Sincerely, Ramsey remarked. With annuities, you can be required to pay commissions, insurance premiums, rider costs, investment management fees, and surrender fees. Thank you, but no! We’ll get by.

Investigate Growth Funds

Growth funds are frequently connected to large, well-known corporations. These are seen more favorably by Ramsey, who claims that they “will create a stable foundation for your portfolio.” He advises putting 25% of your money into growth funds.

SEE MORE –

Illinois Winner of $552M Mega Millions Jackpot Revealed as Chicagoland Local

Keep in mind that “aggressive growth funds,” which frequently made investments in “smaller, newer companies (like start-ups or small businesses), so there’s a little more risk involved, but the payoff could be bigger too,” are not the same as “growth friends.”

International money are another option. These, too, have the potential to be significant assets in a well-rounded 401(k) investing portfolio.

“International funds, also referred to as foreign or overseas funds, are fantastic for a few reasons,” stated Ramsey. They first let you invest in businesses that are not American. Second, they aid in portfolio diversification and risk distribution.

Rely on Expert Assistance

In the end, this can be a very difficult and possibly perplexing area. Seek professional advice when selecting your 401(k) assets.

Many consumers are unaware that they can choose their 401(k) assets in collaboration with an outside specialist, but Ramsey clarified that this is possible. “Other investors are concerned about the cost of hiring their own investment professional.”

“A one-time fee for a 401(k) consultation may be charged by your investment professional, but that is a fair price for the time they spend assisting you in making wise 401(k) decisions,” he stated. “Just make sure there are no surprises by being aware of what to expect before your appointment.”