In California, new laws take effect on July 1. Drug testing equipment must be present in bars and clubs, and weapons buyers will be subject to an extra 11% state tax. It will be against the law for restaurants and holiday homes to impose additional costs.

The specifics of the new laws that go into effect are listed below.

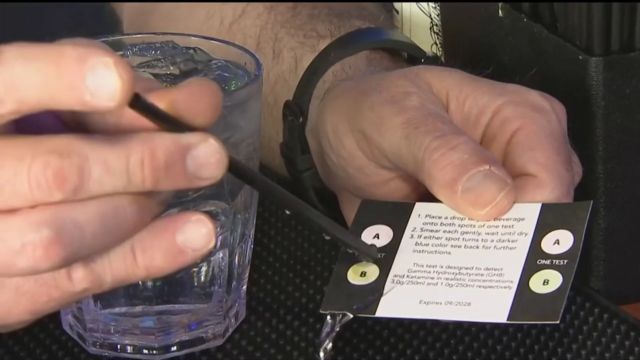

Devices for checking for drugs sold in bars (AB 1013)

Drug testing kits must be offered and sold to patrons at fair costs by bars and nightclubs with permits to serve alcohol in public.

Additionally, they have to put up a sign stating that the testing equipment is for sale. The drug test kit is capable of identifying the presence of ketamine and flunitrazepam, also known as roofies. This law forbids minors from entering establishments that sell alcohol.

The gun tax (AB 28)

Image – NBC 7 San Diego

Purchasers of ammunition and firearms in California will be subject to an extra 11% gross receipts tax. The first state in the union to implement this kind of tax is California. Federal taxes on the acquisition of firearms currently range from 10 to 11%.

SEE MORE –

What’s Changing in Illinois on July 1, 2024: New Laws Explained

California anticipates that the new tax will successfully restrict firearms. It is projected that the measure will generate an extra $160 million in tax revenue per year. Programs aimed at preventing gun violence will be funded by the tax in California.

A row of wooden bar counter glasses filled with a variety of drinks

The new rule mandating that pubs and nightclubs have drug testing equipment on hand will take effect on July 1, 2024.

Ban on hidden fees (SB 478)

All fees and costs have to be disclosed up front in restaurants and holiday homes. The purpose of this rule is to end the recent practice of well-known eateries and accommodation facilities adding “junk fees” to the purchase price.

In particular, eateries are not allowed to add unstated fees to patrons’ bills after they have ate and must display all prices on the menu.

Menstrual products must be available in public schools (AB 367).

kids in grades 6–12 will now receive free menstruation products from public schools; this program will be extended to kids in grades 3–12. Additionally, all community college districts and California State University will provide free menstruation supplies.

Ability to Mend (SB 244)

When selling devices for more than $50, the bill mandates that electronics producers provide a fair marketplace for documentation, spare parts, and tools for future repairs.

Products costing $100 or more are required to provide repair parts and instructions for seven years following the date of manufacture. Cell phones, computers, tablets, and other electronic devices made and sold in California on or after July 1, 2021 are covered by the statute.

Deposit Cap for Security (AB 12)

Landlords in California are prohibited from requesting security deposits greater than one month’s rent. In addition to the first month’s rent, landlords used to be able to demand a two-month security deposit for unfurnished apartments and a three-month security deposit for furnished apartments.