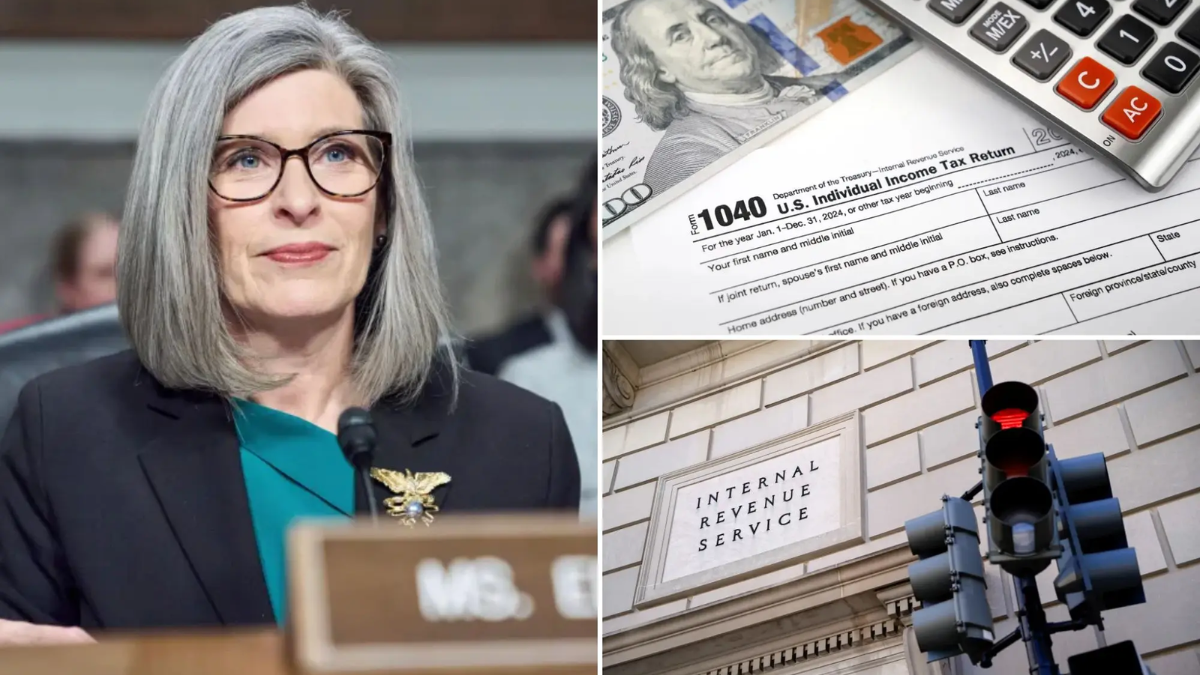

Senator Joni Ernst (R-Iowa) is taking aim at tax delinquency within the very agency tasked with collecting the nation’s taxes. On April 12, 2025, Ernst introduced a new bill that would require the Internal Revenue Service (IRS) to collect approximately $46 million in unpaid taxes owed by its own employees.

The proposed legislation, known as the TRUST (The Reduce Unpaid IRS Staff Tax) Act, is already making waves on Capitol Hill.

The TRUST Act: Holding IRS Employees Accountable

According to the Treasury Inspector General for Tax Administration (TIGTA), over 1,250 IRS employees owed back taxes in fiscal year 2021, totaling an estimated $46 million.

The TRUST Act seeks to address what Ernst and her supporters see as a glaring inconsistency—IRS agents enforcing tax compliance on Americans while failing to comply with the same laws themselves.

In a statement, Ernst said, “It’s the height of hypocrisy for IRS employees, who are charged with collecting Americans’ taxes, to themselves be delinquent.”

The bill proposes that any IRS employee who fails to resolve their tax debt within six months would face mandatory termination. Furthermore, the bill would require the IRS to report annually to Congress the number of employees who owe taxes and what actions were taken to recover the debt.

The bill also encourages transparency by requiring the IRS to publicly disclose the aggregate amount of unpaid taxes by its employees each year.

Mixed Reaction from Lawmakers and Analysts

Ernst’s proposal has received mixed reactions. Many Republican lawmakers have expressed support for the legislation, arguing that accountability is essential, particularly within federal agencies that hold significant enforcement power.

Sen. Rick Scott (R-FL), a vocal proponent of federal accountability, called the bill “common sense,” adding that “the American people expect everyone to pay their fair share—especially IRS employees.”

However, some Democrats and government watchdogs warn that the measure could have unintended consequences. Critics argue that most of the IRS employees cited in the TIGTA report are not willfully evading taxes but are entangled in disputes or payment plans that make immediate resolution difficult.

They caution against implementing punitive actions without investigating individual circumstances.

The National Treasury Employees Union, which represents many IRS employees, also voiced concern. In a statement, they emphasized that IRS workers should not be singled out for circumstances that are often resolved through existing internal processes.

Background: A History of Delinquency Among IRS Staff

Tax delinquency among IRS employees is not a new issue. In fact, TIGTA has been reporting on the matter for years. What makes the situation particularly concerning to lawmakers like Ernst is the growing number of delinquent staff at a time when the IRS has been allocated billions in additional funding to hire new agents and enhance tax enforcement.

The $80 billion boost to the IRS under the Inflation Reduction Act aimed to increase audits on high-income earners and improve taxpayer services. However, Ernst and other Republicans argue that the agency must first ensure its own house is in order before expanding its reach.

“We should not be adding more IRS agents until we know those already on the payroll are meeting the same tax standards required of every American,” Ernst said during a press conference.

Political Implications: IRS Under Renewed Scrutiny

The TRUST Act arrives amid heightened scrutiny of the IRS by Republican lawmakers. Since the passage of the Inflation Reduction Act in 2022, which significantly increased the IRS’s funding, the agency has become a focal point in the broader debate over government spending and accountability.

Republicans have pushed back against what they describe as overreach, particularly after reports of increased audits targeting middle-income families and small businesses. The issue of IRS employees owing back taxes has given critics more ammunition to question the agency’s integrity and oversight.

What Comes Next for the TRUST Act?

The bill has been referred to the Senate Finance Committee, where it will face deliberation. Given the divided nature of the current Congress, its future is uncertain. If the TRUST Act advances, it may force a bipartisan discussion on ethics, accountability, and reform within federal agencies.

Some policy analysts believe the bill, even if it does not pass, will increase pressure on the IRS to tighten internal enforcement and boost public reporting. Ernst has also indicated she may push for amendments that would expand the policy to include all federal agencies, not just the IRS.

Conclusion: A Push for Accountability in Government

Sen. Joni Ernst’s TRUST Act is part of a broader campaign to restore public trust in government institutions. By targeting IRS employees with outstanding tax debts, the legislation underscores a basic but powerful message: those who enforce the rules should also follow them.

Whether the bill gains enough momentum to pass remains to be seen, but it has already sparked a national conversation on fairness, transparency, and the responsibilities of federal workers.

As lawmakers on both sides of the aisle continue to debate the merits of the bill, Americans are watching closely to see whether accountability will truly be enforced at all levels—even within the taxman’s own ranks.

For more insight on TIGTA’s findings and IRS oversight, visit the Treasury Inspector General for Tax Administration’s official reports.

Disclaimer – Our team has carefully fact-checked this article to make sure it’s accurate and free from any misinformation. We’re dedicated to keeping our content honest and reliable for our readers.